Friday, July 31, 2020

2019 Nov (Linear Demand Slope of Supply Output/Costs/Revenues Consumer Surplus) Paper 3 HL

2019 Nov (Output/Costs/Revenues) Paper 3 HL

(1) (b) Using a fully labeled diagram, outline the relationship between marginal product (MP) and average product (AP) of labor.

Understand that as MP is above the AP it must be pulling the average (AP) up, as the marginal product intersects the AP the two are equal, when the MP is below the AP it pulls the AP down.

Think of it like this – if there is a group of people in a room and all of them are 6 feet tall – the average in the room is obviously 6 feet.

If the marginal (additional) person (MP) walks into the room and is above the average 8ft tall then the average (AP) increases.

If the marginal (additional) person (MP) walks in the room and is below the average 5ft tall then the average (AP) falls.

**Marginal product will fall (due to diminishing returns) will intersect the AP curve at its maximum, because if the MP>AP then AP increases and if MP<AP then AP will decrease.

Thursday, July 30, 2020

2019 May (Income Tax) Paper 3 HL

(e) (i) Define the term Marginal rate of tax.

The proportion of any additional income which must be paid as tax.

Fred is a low-wage worker in Fairland. As a result of the minimum wage his income will increase from $15,000 per year to $19,000 per year.

(ii) Calculate how much additional income tax Fred will need to pay.

Fred initially pays – 5% of the 1st $10,000 of income that he makes = $500

Fred also pays - 10% of the $5,000 of income that he makes = $500

Therefore Fred pays $1,000 of tax on his old income

Then he gets a raise to $19,000

Fred will pay 5% on the 1st $10,000 of income that he makes = $500

Fred also pays 10% of the next $8,000 of income = $800

Fred also pays 20% on the next $1,000 that he earns = $200

Fred pays $1,500 on the new income that he earns.

Originally Fred paid $1,000 of tax now with the raise Fred pays $1,500 so the change in tax would be $500.

2019 May (Unemployment, Price Floor, Minimum Wage) Paper 3 HL

(a) Calculate the unemployment rate in Fairland using Table 1.

= 26.57% or 26.69%

(b) Outline 2 difficulties in measuring unemployment.

·Discouraged workers/Hidden Unemployment – some people who are able and willing to work have become discouraged and have given up looking for work.

·Underemployed – do not full utilize their time (involuntary part-time workers) skills/experience.

·Unemployment Fraud – Claims by those who seek to obtain unemployment benefits, or those in the informal labor market seeking to avoid tax that distort the official unemployment statistics.

·Unemployment Averaging – the unemployment figure is an average and ignores regional, ethnic, age, and gender disparities.

(c) Draw and label a curve that illustrates Fairland’s minimum wage on figure 6.

(a) Calculate the resulting unemployment among low-wage workers.

At a minimum wage (price floor) of $10

Only 14m workers will be employed while 40m will supply their labor

Therefore there will be a surplus of workers of 26m = 40m – 14m

Surplus workers means – unemployed workers.

2019 May (Exchange Rates, Floating Exchange) Paper 3 HL

(g) Explain 2 possible economic consequences for the Euro zone if the Euro appreciates.

·Exports decrease as foreigners find the Euro Zone’s goods to be more expensive and Imports increase as an appreciating currency has more purchasing power.

·As the price of imports falls, costs of living will fall as does costs of imported raw materials, lowering production costs and reducing pressure on the Price Level.

·Exports decrease shifting AD leftward reducing the PL, reducing growth and increasing unemployment.

·Value of foreign debt may be reduced.

·FDI inflows may decrease as it becomes more expensive to purchase assets in the euro zone.

·FDI outflows may increase as it becomes less expensive to purchase assets outside of the euro zone.

(h) Calculate the quantity of EU € she will receive for her US$300, 000.

300000/1.2 = €250,000

The EU€ depreciates by 10% against the US$. Fearing further depreciation of the EU€ Tanya exchanges her EU€ for US$.

(I) Calculate, in US$ the loss made by Tanya as a result of these transactions.

Understand – If the € gets weaker that means the $ gets stronger – meaning that it takes less US$ to buy 1 €.

New Exchange Rate = €1 = US$ 1.20 x .9 = US$ 1.08

€250,000 can be exchanged for 250,000 x 1.08 = US$ 270,000

Loss = 270,000 – 300,000 = US$30,000

(j) Explain 2 reasons why a government might prefer a floating exchange rate system for its currency.

·Floating Exchange rate system allows for independent monetary policy. Interest rates can be set in order to influence AD without fear of disrupting the (fixed) exchange rate.

·Exchange Rate Policy can be used to affect macroeconomic variables, such as growth/inflation.

·If the current account deficit/surplus, the exchange rate will act as a self-regulating mechanism to restore balance.

·The Central bank does not need to purchase foreign reserves: (involving an opportunity cost) to be able to intervene in the Foreign Exchange Market.

Wednesday, July 29, 2020

2019 May (World Price, Consumer Surplus) Paper 3 HL

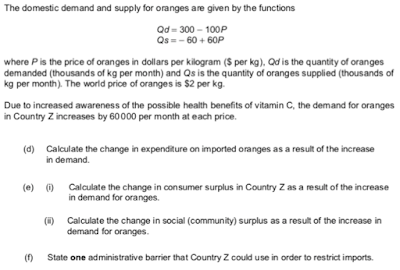

Due to increased awareness of the possible health benefits of vitamin C, the demand for oranges in Country Z increases by 60,000 per month at each price.

(d) Calculate the change in expenditure on imported oranges as a result of the increase in demand.

Old Imported Amount = 40,000

New Imported Amount after Change in Demand = 100,000 at $2 price

Change in Demand = 60,000

Change in expenditure = 60,000 x 2 = $120,000

(e) (i) Calculate the change in consumer surplus in Country Z as a result of the increase in the demand for oranges.

(ii) Calculate the change in social (community) surplus as a result of the increase in the demand for oranges.

Change on Producer Surplus = 0

Change in Consumer Surplus = 78,000

Change in Community Surplus = Change in CS + Change in PS = 78,000

(f) State one administrative barrier that Country Z could use is order to restrict imports.

·Requirements for packaging/labeling

·Health/safety inspection procedures

·Changes in permitted specifications for a product

·Increased bureaucracy

2019 May (Comparative Advantage) Paper 3 HL

(a) Sketch and label a diagram to illustrate comparative Advantage between Country X and Country Y.

(b) Outline the reason why Country X should specialize in the production of apples and Country Y should specialize in the production of bananas.

Country X should specialize in Apples because the opportunity cost is lower and because specialization will increase output (shift the PPC out) or this will increase its consumption possibilities/ increase (global) efficiency and may result in lower prices.

(c) Outline one reason why it might not be in the country’s best interest to specialize according to the principle of comparative advantage.

·Unemployment – workers might not be able to take advantage of areas of comparative advantage.

·Over-Specialization – resulting in vulnerability (lack of diversity in production of goods) to changes in market conditions or as barriers to economic development.

·Over-Reliance – on trading partners for essential products or resources, which might compromise national security (antibiotics) or diminish negotiating power.

·Safety – and environmental standards may be compromised by low-quality imports (hand sanitizer, dog food).

·Barriers – Specialization may not result in beneficial trade if barriers to trade protect export markets. (Any gains in specialization may be wiped out due to trade restrictions).

·Demand Conditions – deteriorate for exported goods the country’s terms of trade may be harmed.

·Slow Growth – due to overspecialization in good with low income elasticity of demand.

Tuesday, July 28, 2020

2019 May (Linear Demand, Slope of Supply, Producer Surplus) Paper 3 HL

(a) Identify the slope of the supply curve.

The supply curve is -45 + 4.5P

(b) Outline the reason why the Qs increases as the price increases.

· At a higher price, the profit margin is greater, so there is an incentive to produce and offer more units. (my favorite)

· As price increases, profits will be maximized at a higher level of output given an upward-sloping MC curve

· As marginal costs rise, a firm will be willing to offer more units per period on;y at a higher price.

An increase in the costs of production has resulted in a new supply function:

Qs = -60 +3P

(c) Draw and label the new supply curve on figure 1

Step 1. Make Qs zero and solve

Step 2. Make P zero and solve

Step 3. Plug in a number and solve

Step 1

Qs (0) = -60 + 3P

Qs (0) = -60 + (3 x 20)

Qs (0) = -60 + 60

When P = 20, at a price of 20 there will be zero (0) units supplied

Step 2

Qs = -60 + (3 x 0)

Qs = -60

When P = 0, at a price of zero there will be -60 units supplied

Step 3

Qs = -60 + 3P

Qs = -60 + (3 x 60)

Qs = -60 + 180

Qs = 120

When P = 60, there will be 120 units supplied

What if we chose a price of 80 and solved

Qs = -60 + 3P

Qs = -60 + (3 x 80)

Qs = -60 + 240

Qs = 180

When P = 80, there will be 180 units supplied

|

| Notice that as the cost of goods increase the supply curve shifts to the left |

· An increase in the costs of production will reduce profitability, causing producers to be less willing to supply units of this good.

· An increase in costs of production will increase the price at which producers will be willing to supply the same quantity.

(e) Calculate the change in producer surplus resulting from the increase in costs of production.

PS #1 = 20 x 90,000/ 2 = 900K

PS #2 = 20 x 60,000/ 2 = 600K

A decrease of 300,000 in Producer Surplus

Saturday, July 18, 2020

2017 (World Price/ Tariffs) Paper 3 HL

(c) Using the diagram on page 10, calculate the import expenditure on rice.

$3 x (11,000 – 2,000) = $27,000

Local domestic producers produce 2,000kg of rice when the price of rice is $3 but the quantity demanded by domestic citizens is 11,000.

9,000kg of rice are bought at $3 a kg therefore $27,000 was spent on imported rice.

(e) Alpha’s government decides to impose a $2 tariff on each kilogram of imported rice. Using the diagram on page 10, calculate the government revenue that results from the imposition of the tariff.

The Tariff is $2 and it’s only charged on goods that are imported.

The $2 tariff raises the price of rice to $5 per kg and our domestic producers will produce 6,000kg of rice and 9,000 kg of rice will be demanded.

That means that 3,000kg will be imported at $2 per kg =

$2 x 3,000 = 6,000 = Gov’t Revenue

2018 Nov (WTO) Paper 3 HL

(d) State 2 functions of the WTO

Promote Trade Liberalization (removal of trade barriers/ lowering of tariffs)

Set Trade Rules

Ensures trade rules are followed

Settles trade disputes

Trade-related technical assistance

Forum for trade negotiations

(iii) Explain one possible advantage and one disadvantage for the Sam Marcus economy of the decision to join the WTO and slowly liberalize trade.

Advantages

- Since tariffs and other trade restrictions will be removed, consumers will enjoy cheaper and a greater variety of imports.

- Since tariffs and other trade restrictions will be removed, production costs for domestic firms using imported inputs will be lower.

- Domestic firms will have easier access to foreign markets increasing their exports

- Domestic firms that grow may face lower average costs

Disadvantages

- Overspecialization may render the economy vulnerable to changes in the prices of exports and imports.

- Domestic industries unable to compete with foreign producers may suffer job losses.

- Harder to establish new industries due to the competitive advantages of foreign producers.

- Loss of tariff revenues which could be used for public investment.