1. Firm A produces cartons of coffee. Figure 1 illustrates the firms total cost (TC) and variable cost (VC) at different output levels per month.

(a) (i) Calculate Firm A’s average fixed costs when it is producing 125 cartons of coffee per month.

Recognize that the vertical distance between the TC & VC curve is the FC.

Quantity of 125

TC = 2000

VC = 1500

TC – VC = FC

2000 – 1500 = 500 (FC)

The question is asking for Average Fixed Costs (AFC)

AFC = FC/Q

500/125 = 4 (AFC)

(ii) Calculate a Firm A’s average variable cost (AVC) when it’s producing 125 cartoons of coffee a month.

Quantity = 125

VC = 1500

AVC = VC/Q

AVC = 1500/125 = 12 (AVC)

(b) (i) Using Figure 2, calculate the AFC when 80 cans per month are produced.

AFC is the vertical distance between the ATC & the AVC curves.

Quantity produced 80

ATC = 25

AVC = 20

AFC = ATC – AVC

AFC 5 = 25 - 20

(ii) Using Figure 2, Calculate the Total costs when 55 cans per month are produced.

The output is 55 cans so the ATC is 30

TC = ATC x Q

$1650 = 30 x 55

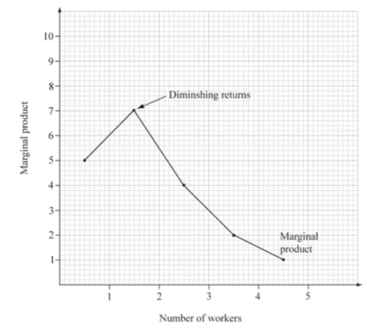

(iii) Explain why in the short-run, as output increases, marginal costs typically dccrease and then increase.

The Marginal Product initially tends to increase due to specialization, but then because of a fixed input (Factor of production, Fixed Capital) diminishing returns causes the MP to eventually fall and increasing the Marginal Costs.

The price of tea in the perfectly competitive tea market is presently $21 per can.

(c) (i) Using this information, draw and label the average revenue curve on Figure 2.

(ii) Using Figure 2, identify the quantity of cans per month Firm B must produce

on order to maximize profits.

Profit Max = MR = MC

Profit Maximizing Output Level = 105

(iii) Calculate the economic profit when Firm B is producing at the output level

identified in part (c)(ii).

If P < ATC = Loss

P – ATC (Q) = Loss

21 – 23 = 2 x 105 = -210

(d) Sometimes a firm continues to produce in the short-run, even when it is making economic losses. Explain why.

In the short-run, the firm should continue to produce as long as the price covers (Average) variable costs, since it’s making a contribution to its fixed costs,

Or,

The firm’s losses are less than its fixed costs, so its losses would be greater if it was to shut down.

Shut-Down Point is where P = Minimum of the AVC

If the Price = the minimum of the AVC, then no fixed costs are being covered and if the price falls even lower then VC (labor) will not be able to be paid.

If my rent (a fixed cost) is $500 a month and my losses are $250 should we shut-down?

The answer is no because as long as I’m running my business I’m at least making (covering) $250 that can be paid toward my rent. If I shut down I owe the whole $500 for the rent.

Understanding – Even when making a loss I might want to keep operating as long as I’m covering some of my fixed costs (rent). If I can’t pay any of my fixed costs (rent) from running the business it’s best for the business to be shut-down.

(e) Outline why a perfectly competitive firm is a price taker.

If the firm raises its price both the quantity sold and revenue will drop to zero and there is no reason to lower its price as it can sell all it wants at the market price.