2019 Nov (Monopoly) Paper 1 HL

Microeconomics

(2) (b) Discuss the view that barriers to entry in a monopoly will always lead to abnormal profits in the long run.

· Definitions of barriers to entry, monopoly, abnormal (economic) profit, long run.

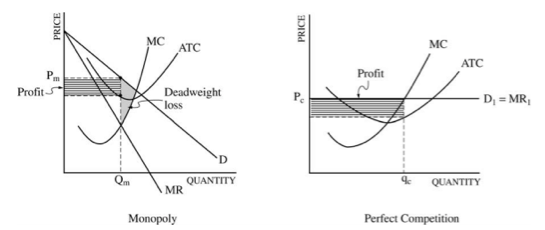

· Diagram showing a monopoly realizing abnormal profit.

· Explanation that monopoly firms can maintain monopoly profits in the long run because of barriers to entry such as economies of scale, branding and legal barriers.

· Examples of specific barrier to entry that enable monopoly firms to make abnormal profits in the long run practice.

· Synthesis or evaluation

Definitions

Barriers to Entry – are the constraints that keep other firms from entering a market /industry and they include (1) Resource ownership (2) Patents and copyrights (3) Government restrictions and (4) EOS/start up costs

Monopoly – when a single person or entity is the sole supplier of a good/service.

Abnormal (Economic) Profits – profit above a normal return on their investment

Long Run – all factors of production are variable.

Abnormal Profit Monopoly & Perfectly Competitive Firms

Monopoly firms do not always earn abnormal profits even with barriers to entry due to:

· Insufficient demand of products - (resulting from changing consumer tastes, technological obsolescence)

· Government Regulation – governments often regulate or naturalize monopolies resulting in lower prices and profits.

· Different Goals – monopolies often have different goals than profit maximization, such as revenue maximization, technological development.

CONTROL OF A PHYSICAL RESOURCE

Another type of natural monopoly occurs when a company has control of a scarce physical resource. In the U.S. economy, one historical example of this pattern occurred when ALCOA—the Aluminum Company of America—controlled most of the supply of bauxite, a key mineral used in making aluminum. Back in the 1930s, when ALCOA controlled most of the bauxite, other firms were simply unable to produce enough aluminum to compete.

As another example, the majority of global diamond production is controlled by DeBeers, a multi-national company that has mining and production operations in South Africa, Botswana, Namibia, and Canada. It also has exploration activities on four continents, while directing a worldwide distribution network of rough diamonds. Though in recent years they have experienced growing competition, their impact on the rough diamond market is still considerable

LEGAL MONOPOLY

For some products, the government erects barriers to entry by prohibiting or limiting competition. Under U.S. law, no organization but the U.S. Postal Service is legally allowed to deliver first-class mail. Many states or cities have laws or regulations that allow households a choice of only one electric company, one water company, and one company to pick up the garbage. Most legal monopolies are considered utilities—products necessary for everyday life—that are socially beneficial to have. As a consequence, the government allows producers to become regulated monopolies, to insure that an appropriate amount of these products is provided to consumers. Additionally, legal monopolies are often subject to economies of scale, so it makes sense to allow only one provider.

PROMOTING INNOVATION

Innovation takes time and resources to achieve. Suppose a company invests in research and development and finds the cure for the common cold. In this world of near ubiquitous information, other companies could take the formula, produce the drug, and because they did not incur the costs of research and development (R&D), undercut the price of the company that discovered the drug. Given this possibility, many firms would choose not to invest in research and development, and as a result, the world would have less innovation. To prevent this from happening, the Constitution of the United States specifies in Article I, Section 8: “The Congress shall have Power . . . To Promote the Progress of Science and Useful Arts, by securing for limited Times to Authors and Inventors the Exclusive Right to their Writings and Discoveries.” Congress used this power to create the U.S. Patent and Trademark Office, as well as the U.S. Copyright Office.

Patent

A patent gives the inventor the exclusive legal right to make, use, or sell the invention for a limited time; in the United States, exclusive patent rights last for 20 years. The idea is to provide limited monopoly power so that innovative firms can recoup their investment in R&D, but then to allow other firms to produce the product more cheaply once the patent expires.

Trademark

A trademark is an identifying symbol or name for a particular good, like Chiquita bananas, Chevrolet cars, or the Nike “swoosh” that appears on shoes and athletic gear. Roughly 1.9 million trademarks are registered with the U.S. government. A firm can renew a trademark over and over again, as long as it remains in active use.

A copyright, according to the U.S. Copyright Office, “is a form of protection provided by the laws of the United States for ‘original works of authorship’ including literary, dramatic, musical, architectural, cartographic, choreographic, pantomimic, pictorial, graphic, sculptural, and audiovisual creations.” No one can reproduce, display, or perform a copyrighted work without permission of the author. Copyright protection ordinarily lasts for the life of the author plus 70 years.

No comments:

Post a Comment