(a) (i) On the diagram, draw and label the average revenue curve for Firm A.

(ii) Calculate Firm A’s total revenue if it produces 180,000 units per month.

Total Revenue = price x quantity

Profit max = (MR = MC)

Price = $18 per unit

This firm produces 180,000 units of the good.

Total revenue = $18 x 180,000 = 3,240,000

(iii) Identify Firm A’s short-run profit maximizing level of output.

Profit max = (MR = MC)

The Firms short run profit maximizing level of output (quantity) = 140,000

(iv) Identify Firm A’s short-run abnormal profits or losses at the level of output identified in part (iii)

Total Revenue – Total Costs = Profits/losses

Total Revenue = (Price x Quantity) = 18 x 140,000 = 2,520,000

Total Costs = (AC x Quantity) = 14 x 140,000 = 1,960,000

Abnormal Profit = 2,520,000 – 1,960,000 = $560,000

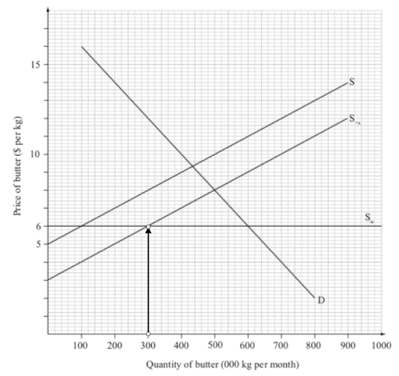

(a) With reference to the diagram, identify the long-run equilibrium price and level of output for Firm A.

P = $12

Q = 120,000

(a) Explain, using a diagram, how Firm A will move from short-run equilibrium to long-run equilibrium.

The existence of abnormal profits of $560,000 in the short-run will attract firms into the industry.

When firms enter into the market the supply of the product increases causing the price to decrease until the firm returns to long-run equilibrium (normal profit)

When firms enter the market the supply of the good increases decreasing the price from $18 to $12, the firm returns to the long-run equilibrium making a normal profit.

Notice that as firms enter quantity for the market increases but a decrease in price causes the firms quantity to decrease.

(d) Define the term satisficing.

The idea that a firm tries to make enough profit to

1) Satisfy different stakeholders

2) Pursue other objectives

3) Because decision makers do not have the necessary information to maximize profits.

Satisficing is a decision-making strategy that aims for a satisfactory or adequate result, rather than the optimal solution.

Why would you want to only aim for a satisfactory result?

Aiming for the optimal result (maximizing) on every single decision in our day can waste energy, resources and definitely time! Also, more effort spent doesn’t necessarily mean you’ll get a more optimal result — there can be diminishing returns on effort.